3 Announcements Feel Like a Batman Comic Strip

Our revenue situation in Arizona reminds me of Batman comics, “Boom! Bang! Pow!” Three blows against us, leaving us without resources to stand up.

These revenue reports are dusty, boring stuff to read. But they tug at my heart because I know the results are more neighbors unable to pay the rent, more children dragging in the door after school because they’ve been bullied, and You wondering, “What can we do to stop the daily stream of news stories spurred by hate? What can we do to promote caring?”

I am not just reading these reports, I am gathering legislators, key economic leaders, educators …. Arizonans to start planning now.

*** And I’m running for re-election to the AZ State Senate.

If you are a professional lobbyist in AZ, please stop reading and let me know so I can mark my email list accurately. I tried to remove all the lobbyists from this list of recipients. If I missed you, please disregard all suggestions of donations. It is not allowed for lobbyists to donate to legislators while the legislature is in session.

Everybody else:

Can you help with a donation today? Click here ***

We need revenue for eviction reduction and incentivizing affordable housing. We need affordable healthcare. We need to fund our schools better, with enough faculty and staff to help every child feel supported. Instead we have

Boom! The universal private school voucher program

from Republican legislators is a large expansion of government without a plan to pay for it.

The AZ Dept of Education came out with a report in early June that the ESA-voucher expansion will cost in the ballpark of a billion dollars. Some of that is accounted in the budget, but about $200 million is expected to be needed above the budget and there is NO plan to pay for it. I support the original ESA – empowerment scholarship accounts — program for students with special needs. The expansion to universal vouchers is causing problems.

Before Republicans passed universal vouchers, taxpayers paid for public schools and ESA s for special needs students. Now taxpayers pay for that –plus private schools and home-schooling for anybody. A staggering majority of voucher expansion accounts are private school and homeschooled students who have never attended public schools. And before you think that this will save the state money – don’t.

Consider this example: Daniel attends a Scottsdale School District school. Local property taxes pay for most of the cost. If Daniel takes an ESA voucher to attend a private, exclusive school, the state has a whole new cost to cover, plus the public school he left does not have any reduced costs when one or several students leave.

*** It is more important now than every before that we have sensible legislators

who carefully evaluate the money we spend and that our revenue is fair, adequate, sustainable and transparent. Would you please make a donation to my campaign for re-election to the AZ Senate today? ***

Universal Vouchers create an inefficient system, leading to waste and failures.

That is an important concept to understand about the finances of school vouchers. Public school districts are set up to manage dollars, people, and time as efficiently as possible. Schools and classrooms are built where needed.

Contrast that to market forces that produce redundancies and inefficiencies like 3 grocery stores in one neighborhood leading one of them to fail, and no grocery stores in the next 4 neighborhoods creating a “food desert” for many people. There are a lot of wasted dollars in that system, and many people do not get the kinds of groceries they need and want. The more we throw public dollars at private school choices, the more inefficient they are likely to become. A system of Have and Have-Not is not what we want for our children’s education.

Universal vouchers are a big, new cost of hundreds of millions of dollars.

Bang! Less Revenue than Expected.

On top of the $200 mil voucher cost, the Joint Legislative Budget Committee (JLBC) projects this fiscal year’s revenues will be down by $175 million, mostly caused by the 2021 Republican flat income tax rate scheme costing more than expected, but also due to an unexpected decline in sales tax collections. Our budget is structurally unbalanced after decades of hand-outs to billionaires and big corporations.

On top of the $200 mil voucher cost, the Joint Legislative Budget Committee (JLBC) projects this fiscal year’s revenues will be down by $175 million, mostly caused by the 2021 Republican flat income tax rate scheme costing more than expected, but also due to an unexpected decline in sales tax collections. Our budget is structurally unbalanced after decades of hand-outs to billionaires and big corporations.

*** To keep fighting for more fairness, I’m running for re-election to the AZ State Senate. Can you help with a donation today? Click here ***

Pow! Any New Revenue Goes to TSMC First.

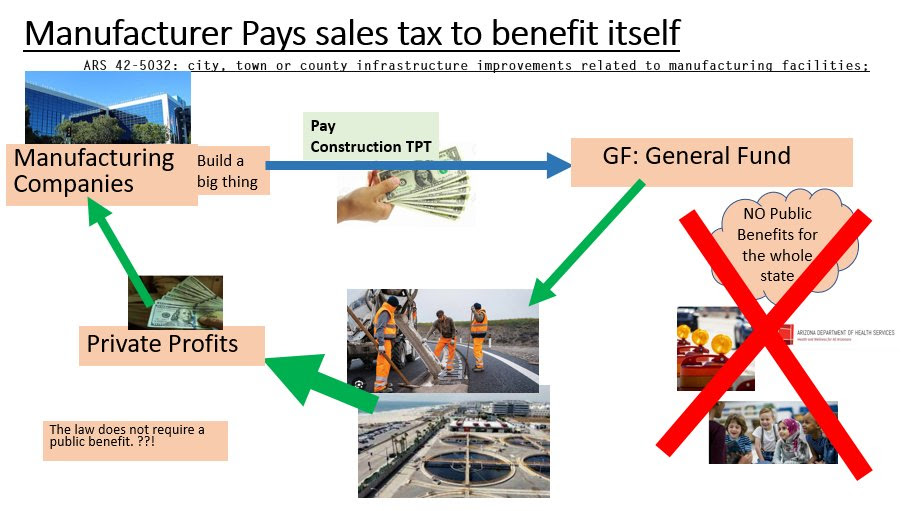

The third blow to our bottom line is HB2809 which dictates that construction sales tax revenue from LG, Intel and TSMC will not go to the state, but will be diverted to pay for facilities that these corporations will use to make profits.

Normally, businesses and residents pay taxes to a city and the city pays for a water treatment plant for public use. However, these large manufacturers get so many tax cuts that cities do not get enough tax revenue from them to pay for a water plant of the magnitude the big corporation needs.

The solution the legislature chose is that you – all the taxpayers of Arizona – should pay for it. I rallied against the expansion of this plan in HB2809, but it passed. I believe that economic development is a positive pursuit, but this law has no guardrails. I am calling for this law to be modified to be accountable to taxpayers by adding some guardrails on the expense and a transparent report. We are glad to have these 3 behemoth corporations in Arizona, but passing this bill means that if Arizona gets any new revenue from them, it cannot be used for teacher pay or KidsCare or anything else. The first $100 million must go to building facilities for these 3 private companies. and that digs our revenue further into the red.

Note the words of this law. The $100 million is “to pay for public infrastructure improvements that are necessary to support the activities of the manufacturing facility.” This law needs to be changed to respect taxpayers, and to require that at least some percentage of the “public infrastructure” is to benefit the public.

On the floor of the AZ Senate, Sen. Mesnard explained his Yes vote on the bill because Chandler, his city, could not afford to pay for the water treatment plant that Intel needed, so Intel made a deal with state lawmakers and the city of Chandler that Intel would pay 20% for a water treatment plant and the state would pay for the rest.

Despite that nice statement, there are still 2 compelling reasons for voting No on HB2809.

1- The law does not require the manufacturing business to pay 20% of the infrastructure cost. According to the law and HB2809, the state pays 80% of the water treatment plant and roads that the manufacturer needs, and maybe the residents of the city pay the rest. Or maybe a County pays the rest. The law needs to be modified to require that if a private business benefits, then the private business has some skin in the game. Intel does. Future users of this law need similar guardrails.

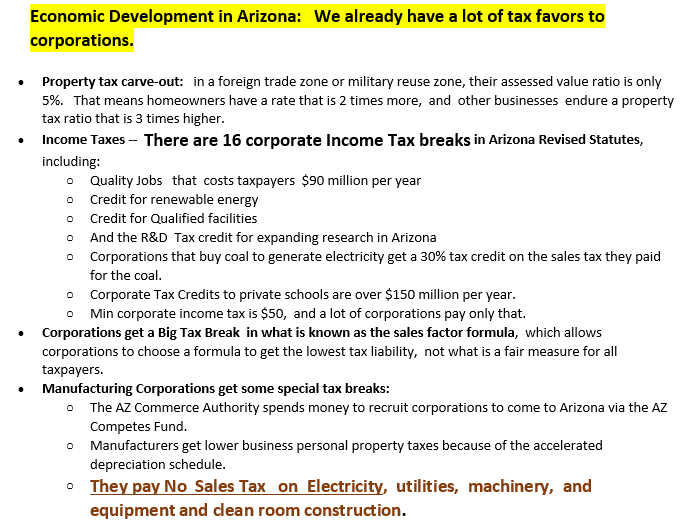

2- The reason that a city does not have the revenue to build huge infrastructure that the manufacturing company needs is because the huge corporation gets so many tax favors in Arizona that the city does not get much — if anything — from it. A shocking number of corporations in Arizona pay only $50 in corporate income tax, the minimum requirement.

I’m calling for FISCAL RESPONSIBILITY

Public school teachers should not have to suffer so that private edu-corporations can profit. If Republican legislators want vouchers to private, exclusive schools and tax subsidies to big corporations, then they need to face the piper and produce a way to pay for them.

And it absolutely must not be an increase in sales tax that will leave the hard-working middle class paying for it all, again.

Corporations should pay their fair share. Too many tax loopholes for a few add up to a lot of unfairness for everybody else.

Our state budgets should uplift every Arizonan, not just a special few.

*** Please join me in the fight for fiscal responsibility in our Arizona State Legislature. Would you please donate to my re-election campaign for the AZ State Senate today? Click here Thank you! ***

As we work on the three big issues facing Arizonans– water, schools, and housing — You must be included in the governance decisions that affect our lives.

If you would like to set up a meeting, or if you are a constituent needing help dealing with state agencies, please call my office: 602-926-4870.

My office door is open!

Senate Minority Leader

AZ State Senator Mitzi Epstein

Legislative District 12 – Ahwatukee, Chandler, the GRIC, and Tempe

Office phone: 602-926-4870

Office email: [email protected]

Paid for by Mitzi Epstein for AZ Senate. Authorized by Mitzi Epstein

Mitzi Epstein

http://mitziepstein.nationbuilder.com/